July 11, 2017

From the Blockchain to Artificial Intelligence

To follow up the previous day’s presentation of new technologies and trends by Christophe Hermanns, the OneLife managers opted for a more pragmatic approach the second day, with addresses by partners working in RegTech, FinTech and other fields besides.

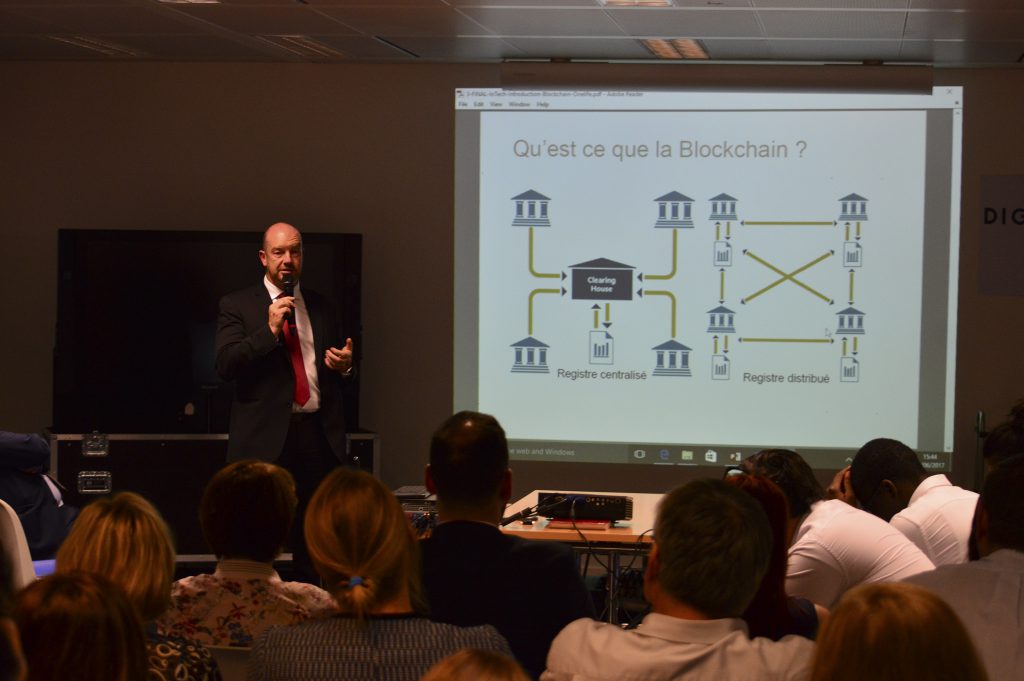

Fabrice Croiseaux, CEO of InTech, started the workshop session with an introduction to the Blockchain. “Internet, and particularly GAFA (Google, Apple, Facebook, Amazon), are the world’s most centralised platforms, which gives them undoubted strike potential,” were this IT expert’s opening words. He went on to state that the purpose of the Blockchain was to provide the same type of secure services, without their being centralised. “The entire history of transactions is recorded but, on the other hand, it is not known who is behind the address. It is important to emphasise that not only virtual money is involved but also smart contracts, cadastral land-registry data, title deeds, etc.”. Among other uses for life-assurance companies, the Blockchain can be used to centralise the distribution of funds.

Next, David Naramski, Partner at Nowina Solutions, set forth to all the staff the advantages of integrating the electronic signature into the finance world. This is currently a project at OneLife, scheduled to materialise in the second half of 2017. “The electronic signature is a compromise between optimum security and a new user experience,” explains David Naramski. A directive has been in existence since 1999, although it left interpretation to the discretion of the EU Member States. Regulations have been in force since 2014, to make for uniformity among electronic signatures. Several tools coexist nevertheless: Advanced Electronic Signature and Qualitative Electronic Signature, allowing the use of a smart phone (via SMS), a tablet or the user’s identity card, depending on the electronic signature used.

Johann Blais, Head of Software Solutions at Ainos, took the chair to share the advances in artificial intelligence “which all of us already use every day, and which was made known to us through many a Hollywood film,” while especially emphasising the Chatbot. His team is working with OneLife to develop a virtual assistant named Olive(R). This will assist business partners in the subscription process through a chat window designed to guide the subscriber, as well as freeing time for the OneLife experts to follow up and customise the services. “Bots can process information more rapidly than humans can ever hope to do,” added Johann Blais.

Next, Luc Maquil, CEO and co-founder of the Luxembourg start-up, KYCTech, shared his vision with the OneLife staff. Both companies announced a Proof of Concept in May this year, at ICT Spring. “Compliance & Risk Officers’ tasks should be facilitated. This involves not a revolution, but rather analysing the different stages – analyses, research, etc. – and automating them,” pointed out Luc Maquil, adding that certain challenges remained: collecting information which can be found in abundance everywhere, cleaning it and, above all, identifying clients’ and partners’ needs. “Technology is worthless if it is not used optimally. It must impart genuine added value,” were the KYCTech CEO’s closing words.

To conclude this practical session, Marc Stevens and Christophe Regnault welcomed Olivier Gentier, the CEO of the French start-up Advize, specialising in automated wealth-management advising, termed “robo-advisor”. “The three missions or pillars of robo-adviser are the user’s experience, the financial adviser and the quest for performance. We often hear it said that the client is at the centre of the strategy, but 97% of the population has no access to genuine financial advice,” explains Olivier Gentier, who sees the robo-adviser as a co-pilot, using several tools. Among these, he cited knowledge of the client and the investor profile, financial advice and investment allocation, then facilitating on-line subscription. After the 2017 summer holidays, Advize and OneLife will launch an offer targeting CGPI independent wealth-management advisers. “This is a first in the Grand Duchy and a genuine revolution,” in the words of Wim Dieryck, Chief Commercial Officer at OneLife.