July 19, 2018

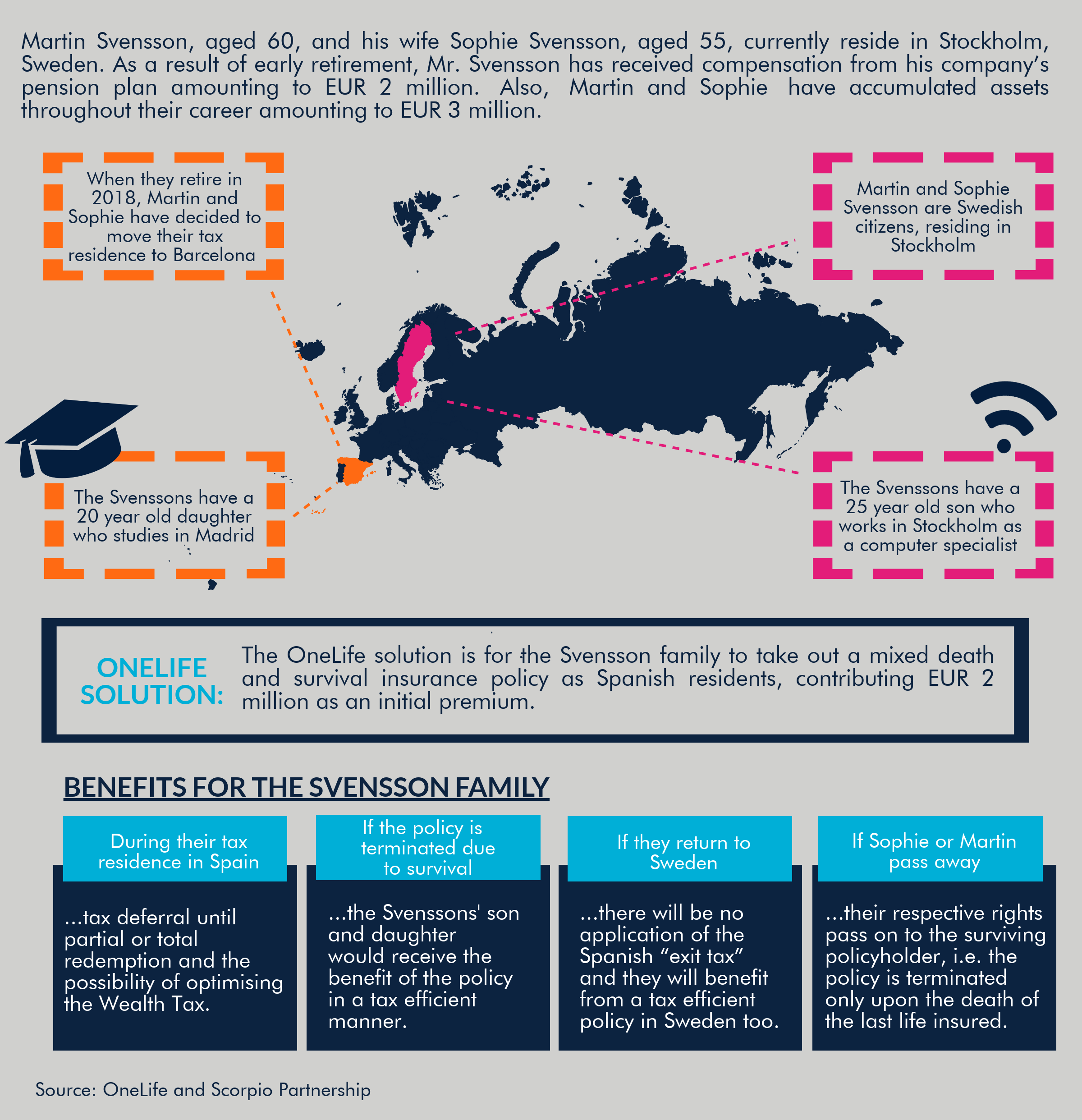

For Martin and Sophie Svensson, having a comfortable retirement was always a goal. They had accumulated enough wealth through decades of hard work and were ready to settle into Barcelona after relocating from Sweden.

As this power couple is moving their tax residence to Spain, a life assurance policy which can offer tax efficiency between these two jurisdictions is a priority.

And while it is a long time away, wealth transfer benefits are also on their mind when looking for the most suitable solution. It is important to Martin and Sophie that the life assurance policy can be used to pass down their wealth with their wishes in consideration.

Martin and Sophie are looking forward to taking early retirement and moving southwards to Spain where there daughter is a student. With a lump sum received from Martin’s company retirement plan as well as other assets which the couple has accumulated over the years, they subscribe a life assurance policy with an initial premium of EUR2 million. They want to ensure that their wealth is well protected, that their children benefit once they have passed away and that the surviving spouse is protected, with the policy only terminating upon the death of the last life assured. The benefits that the Svenssons can enjoy are multiple: tax deferral during the time they are resident in Spain, tax efficiency when passing on the proceeds to their children and if they were to decide to return to Sweden no Spanish exit tax and a tax efficient policy back in Sweden too.

To find out more about how a life assurance solution can help out a family in this scenario, read more in our #Success in #Succession Part II e-Book = > here!

Source: OneLife & Scorpio Partnership