March 22, 2018

Wealth managers are perpetually adapting to meet the needs of Entrepreneurs operating within their own jurisdiction. For this reason, providing the right solutions for Entrepreneurs working cross-border can be even trickier. High-net-worth (HNW) individuals require bespoke cross-border expertise from their financial provider. Notably, our research shows that tax advice is the second most important component of an international wealth management proposition (46%).

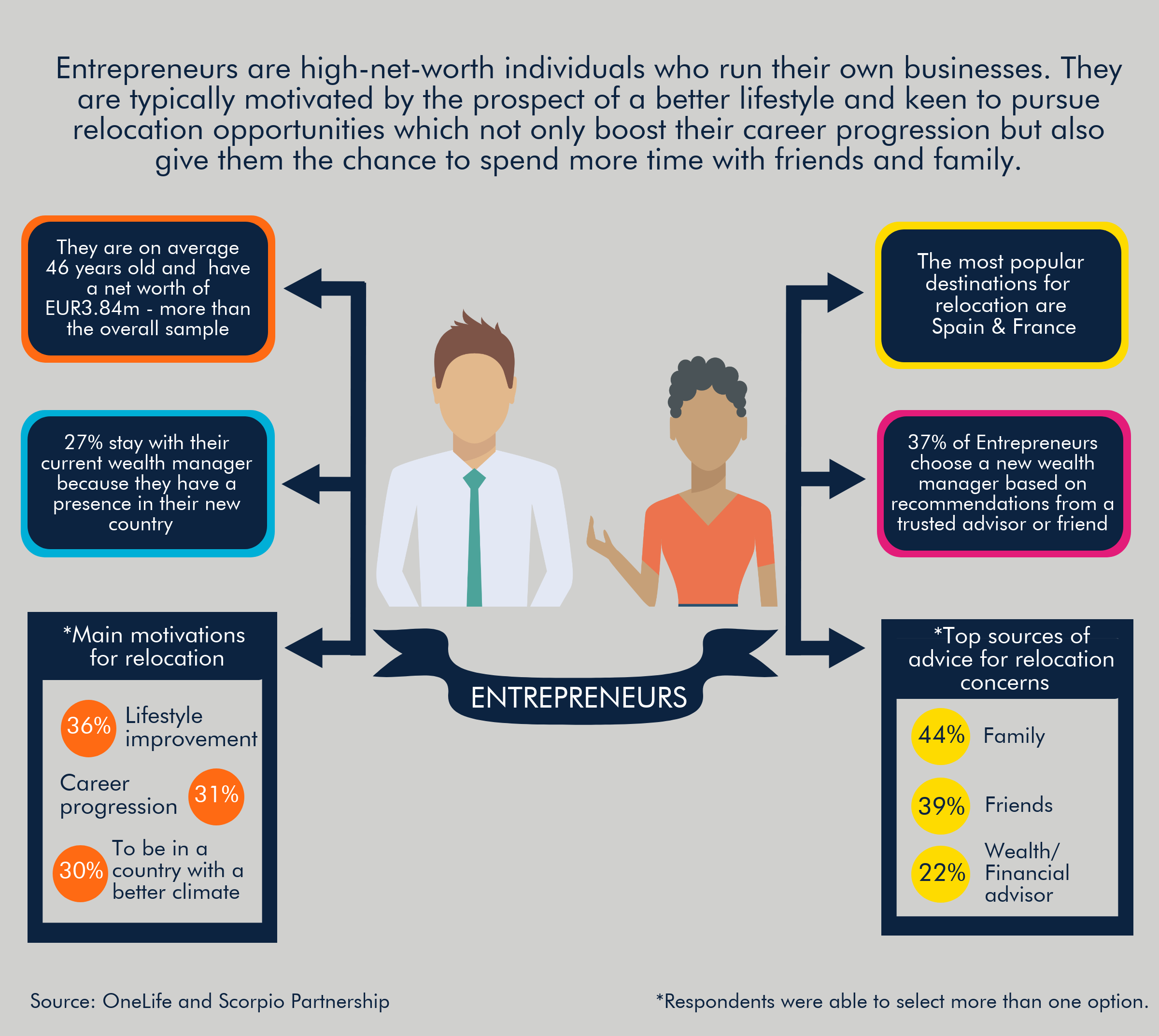

However, beyond professional guidance these individuals look for a wealth manager they can trust; of the business owners surveyed, 37% chose a new advisor abroad based on a recommendation from a trusted friend or advisor.

Keeping up with the needs of HNW relocators is crucial for wealth managers to remain relevant. HNWI’s jurisdiction might change but their need for quality advice does not. By understanding these various personas firms can adjust their proposition to tailor their solutions accordingly.

Download our e-Book to learn more by clicking on the picture below !