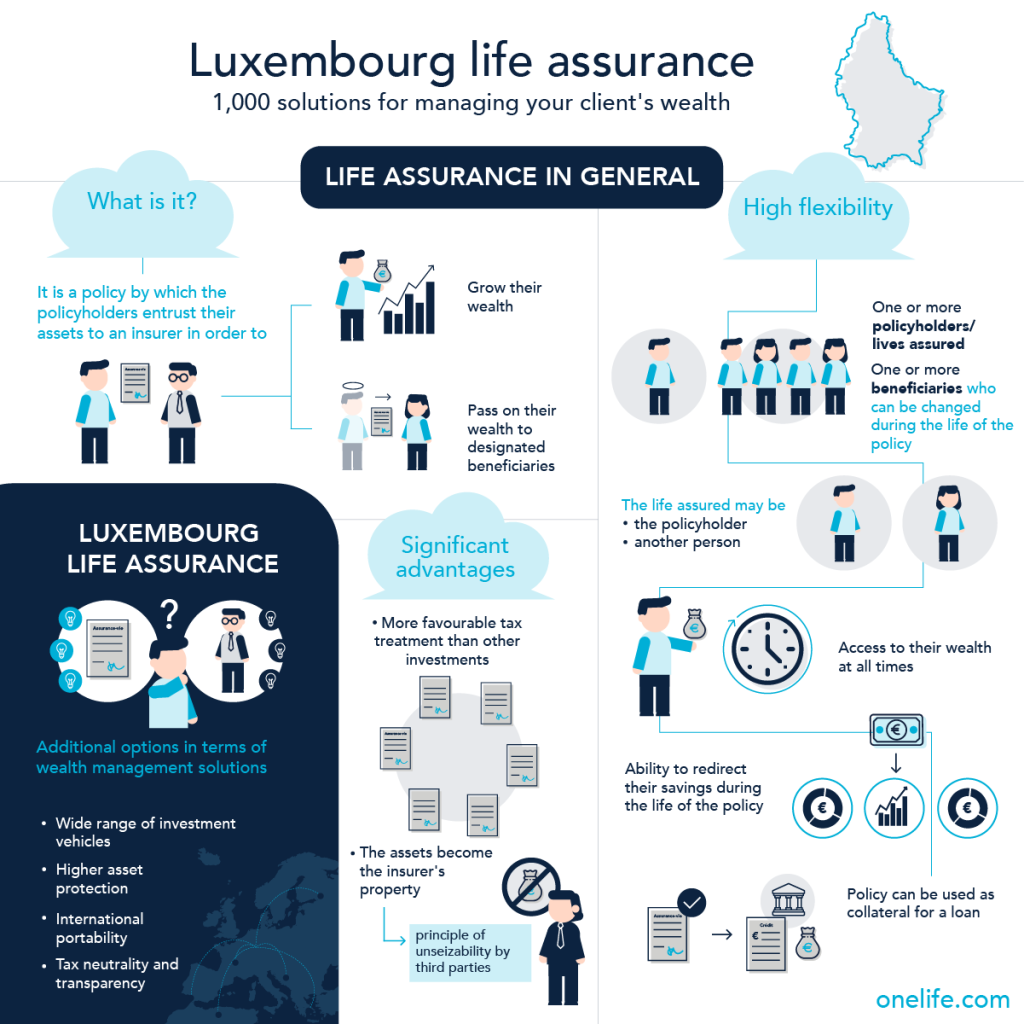

The life insurance policies offered by Luxembourg insurers add to the advantageous characteristics of life insurance in general, unique assets in terms of asset protection, investment flexibility and international portability.

Choosing Luxembourg life insurance means your client benefits from a tailor-made strategy based on their:

- Wealth management objectives

- Investor profile

- Place of residence and that of their beneficiaries

Thanks to innovative legislation designed to adapt to all situations, including the most complex international contexts, Luxembourg life insurance enables to develop tailor-made solutions for all assets.

The three pillars of Luxembourg life insurance

The legal and regulatory context for Luxembourg life insurance policies is based on three pillars that each meet one of the fundamental needs of a person seeking a stable and sustainable solution to invest, secure and pass on their wealth.

- A multitude of investment opportunities

- Optimal protection of the policyholder’s assets

- International legal and tax security

A multitude of investment opportunities

To invest their wealth, your client can invest in four types of vehicles:

Collective investment vehicles

- Two collective investment vehicles, which allow investors to have a personalised combination of standardised investments:

- External funds: these are investment funds offered by reputable international managers which are available for a broad public on the financial markets. Depending on their investment policy, these funds invest in various financial instruments (equities, bonds, money market instruments, etc.), in euros or in other currencies and possibly following certain themes (ESG, a certain industry, geography …).

- Internal collective funds: these are investment funds created by an insurer in collaboration with well-known asset managers to offer a specific investment strategy adapted to the wealth objectives of only the insurer’s clients.

Investments under individual management

- Two individual management vehicles, which make it possible to invest in a solution tailored to the investor’s assets, profile and objectives:

- Internal dedicated funds provide access to a wide variety of financial instruments depending on the investor’s net transferable wealth and the amount invested, as well as the choice of the asset manager (upon insurer’s approval)

- Specialised insurance funds (availability depending on the country of residence) are tailor-made funds to enable increased management freedom (“advisory” management, with the assistance of an investment advisor) or long-term holding of specific assets (“buy and hold” management)

Optimal wealth protection

The Luxembourg legislative and regulatory context and the very nature of life insurance policies offer the policyholder an unparalleled level of protection of their wealth.

This protection is structured around three axes:

- The Triangle of Security: this single policy for protecting policyholders is based on a strict separation between the policyholder’s assets and those of their insurer and that of the bank where the assets under contract are deposited. This separation is accompanied by strict supervision of the insurer and the custodian bank by the Commissariat aux Assurances (CAA), the Luxembourg insurance regulator. The latter has extensive powers to protect the policyholder’s assets under all circumstances. In addition, in the event of the insurer’s default, the Super Privilege guarantees policyholders the absolute priority over the insurer’s other creditors, including the State.

- Unseizability of assets: a fundamental characteristic of life insurance policies, the assets invested in life insurance become the property of the insurer. They cannot therefore be seized by the policyholder’s creditors and remain protected until the expiry of the policy. In addition, only the policyholder has the right to pledge their policy or surrender it, which adds further to the security of the whole.

- Luxembourg’s economic and financial stability: for several decades Luxembourg has continued its development as an international financial centre and remains at the forefront of legislative innovation. Furthermore, the stability of its economy and its public finances has led it to be among the few countries with a Triple A rating.

International legal and tax security

Since the publication of the European Directive on the Freedom to Provide Services, a European client can freely choose their assurance policy in any country of the European Union. Luxembourg has seized this opportunity and has since offered policies to European clients seeking legal and tax security in the event of international wealth situations. Luxembourg life insurance policies ensure this security thanks to:

- The compliance of the policies with international rules

- The tax neutrality of policies (no double taxation)

- International policy portability